In the U.S., the company’s distribution has maxed out, while inventory levels remain high. There are a number of headwinds that continue to pressure BYND stock going forward. But still, Beyond Meat’s BYND stock remains under pressure as revenue continues to fall and solvency concerns persist. Up almost 30% this year from $12 to $16, the company’s stock has managed to grow amid a combination of inflation, pandemic-related shifts in demand, and rising competition. We expect BYND’s stock to likely trade lower due to revenues and earnings missing expectations in its second-quarter results. (Photo by Gado/Getty Images) Gado via Getty Imagesīeyond Meat stock (NASDAQ NDAQ: BYND), a plant-based meat alternative company, is scheduled to report its fiscal second-quarter results on Monday, August 7. Considering our revenue projections of roughly $1.1 billion and 6% margins, almost $66 million in net income is possible by 2023.Packages of Beyond Meat brand plant-based jerky in Lafayette, California, December, 2022. However, it’s reasonable to assume that as Beyond Meat’s business gains scale and the company expands aggressively, it can boost margins to the levels of Tyson Foods in the next few years, so we estimate roughly 6% margins by 2023. Though BYND’s margins remained negative at close to -13% in 2020 (due to the impact of the pandemic), the company’s operations are expected to improve and turn profitable in 2022, with projected margins of 3%. While Tyson Foods posted almost 5% margin in FY2020 (ending 3rd Oct, 2020), the company is a dominant force in the market with its size being significantly larger in comparison, which makes it probably unreasonable to expect similar margins for Beyond Meat, which has still not made any profits. They have sharply improved from -93.3% in 2016 to -4.2% in 2019. Organic growth along with benefits from the recent partnerships are expected to support continued healthy growth in retail as well as the restaurant segments of Beyond Meat, potentially taking the company’s revenues to almost $1.1 billion by 2023.Ĭombine revenue growth with the fact that Beyond Meat’s net income margins (net income, or profits after all expenses and taxes, calculated as a percent of revenues) are on an improving trajectory. Additionally, Beyond Meat is introducing its plant-based meatballs in Coles, the second largest supermarket chain in Australia with over 2,500 stores. After much anticipation, Beyond Meat announced a three-year partnership with McDonald’s in February 2021, under which BYND will be McDonald’s preferred supplier for the patty in the McPlant, a new plant-based burger being tested in select McDonald’s markets globally. This is, in fact, after BYND partnered with Starbucks, Yum Brands, and Sinodis. BYND entered into a partnership with Alibaba Group, whereby its products will be available in Freshippo stores (Alibaba’s supermarkets) in Shanghai. After tying up with Dunkin’ soon after its IPO, Beyond Meat entered China in 2020.

Additionally, the company’s new partnerships will also drive impressive top line growth.

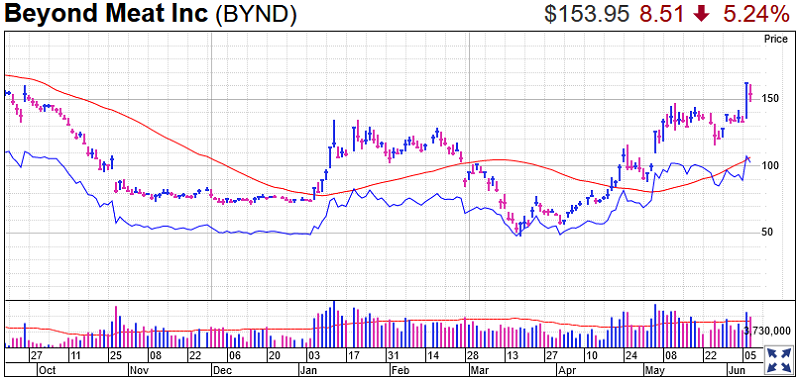

Does this make the stock expensive considering the recent volatility in the stock price? Probably not, considering that revenues are likely to grow almost 2.7x by 2023, with net income turning positive in 2022 and growing steadily thereafter, generating continued returns for shareholders.įirstly, the gradual lifting of lockdowns in recent months will help the restaurant segment register strong growth along with sales from retail chains. With a market cap of over $9.6 billion, the stock now trades a little over 17x projected 2021 revenues, despite the fact that 2020 was the toughest year for the company due to the pandemic and it also missed analysts’ expectations for Q1 2021. (Photo Illustration by Drew Angerer/Getty Images) Getty Imagesīeyond Meat Inc stock (NASDAQ: BYND), a leading-edge food company that produces meat directly from plants – an innovation that provides taste and texture of animal-based meat products along with nutritional benefits of plant-based products – has seen its stock rise by over 160% from the lows seen in March 2020. Beyond Meat is a Los Angeles-based producer of plant-based meat substitutes, including vegan versions of burgers and sausages.

Since going public in early May, Beyond Meat's stock has soared more than 450 percent and its market value is over $8 billion. in a refrigerator, Jin the Brooklyn borough of New York City. NEW YORK, NY - JUNE 13: In this photo illustration, packages of Beyond Meat "The Beyond Burger" sit.

0 kommentar(er)

0 kommentar(er)